Image

Maryland Department of Commerce Announces New RISE Zone Approved Near Towson University

The Maryland Department of Commerce announced the approval of a new Regional Institution Strategic Enterprise Zone, or RISE Zone, adjacent to Towson University in Baltimore County. The designation aims to spur economic development and job creation by allowing certain businesses within the zones to benefit from rental assistance and enhanced investment incentive tax credits.

“Maryland’s higher education institutions are among the most powerful and innovative economic drivers we have,” said Maryland Department of Commerce Secretary Kevin Anderson. “The RISE Zone designation will help Towson University leverage the immense creativity and talent of its people into meaningful economic growth for Baltimore County and for Maryland.”

The RISE Zone designation will help Towson University expand and consolidate its entrepreneurship resources, including the university’s StarTUp at the Armory business engagement center, already located within the zone. The designation will also help establish Towson as a hub for emerging businesses and drive economic development in the Greater Towson community.

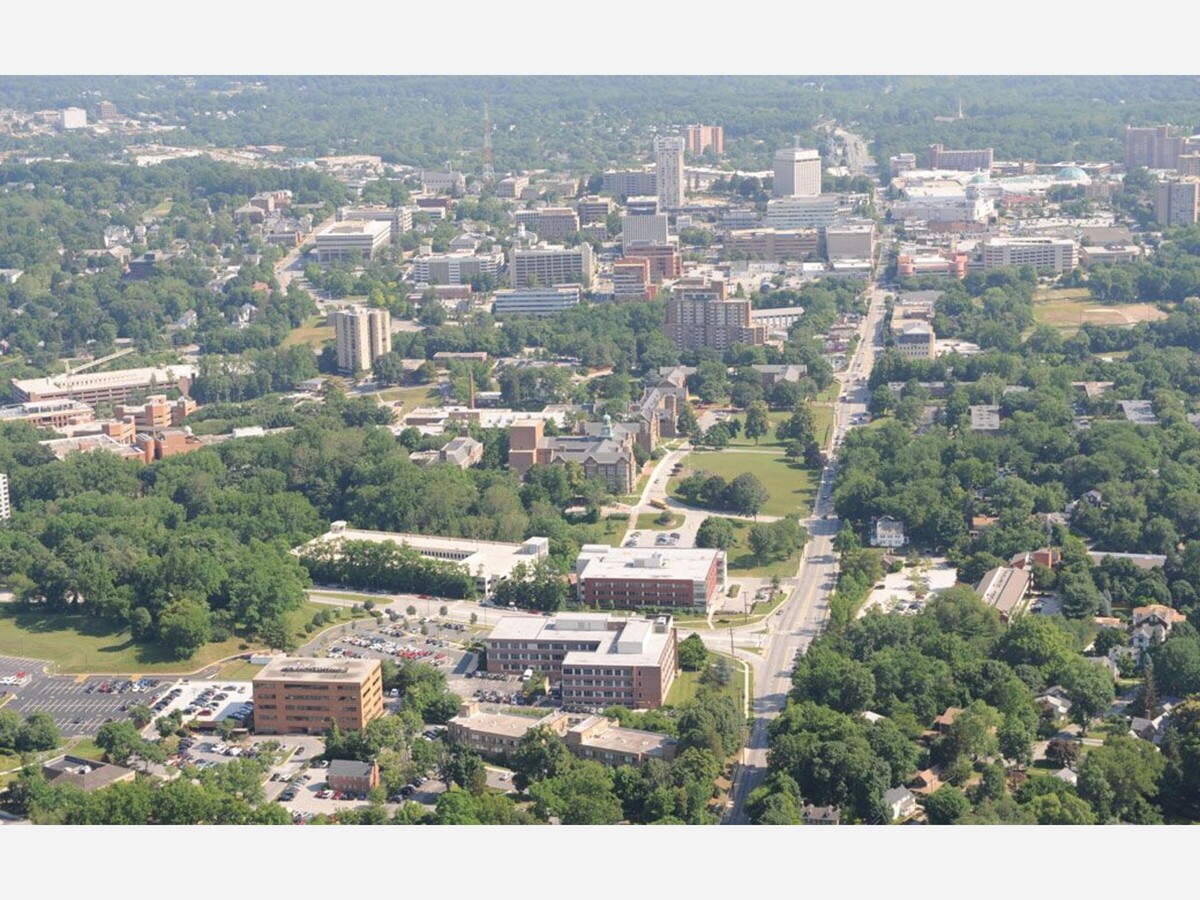

The Zone covers 419 acres reaching from the northeast corner of the university’s campus to a stretch of I-695 north of Kenilworth Avenue and covering the core of downtown Towson.

“Towson University’s RISE Zone designation strengthens its ability to attract new, diverse and forward-thinking businesses to the area, creating new and innovative jobs for residents and furthering Towson’s status as a vibrant destination location,” said Baltimore County Executive Johnny Olszewski. “We value the economic, educational and cultural impact TU has in Baltimore County and beyond, and look forward to continued growth and innovation at this world-class institution.”

Eligible businesses within the zone may apply for rental assistance from Baltimore County and investors in these companies may qualify for enhanced tax credits under the Biotechnology Investment Incentive Tax Credit Program and the Innovation Investment Incentive Tax Credit Program, both offered by the Maryland Department of Commerce. Restaurants and retail stores are not eligible for the RISE zone benefits.

"Towson University's impact as an anchor institution extends far beyond our campus community, and this RISE Zone designation further expands our ability to generate economic growth and business development for the region," said Towson University Interim President Melanie Perreault. "We are thankful to have collaborated with Maryland Commerce and Baltimore County to support our community and its commerce."

The RISE Zone program was established to leverage the economic development potential of Maryland’s higher education institutions. RISE Zone designations last for five years, with the potential to be renewed for an additional five years.

Regional Institution Strategic Enterprise (RISE) Zone Program

Sunset Change - Property and income tax credits are limited to businesses locating in Zone before January 1, 2023.

A RISE Zone is a geographic area that has a strong nexus with a qualified institution and is targeted for increased economic and community development.

Qualified institutions include institutions of higher education, regional higher education centers or non-profits affiliated with a federal agency.

The purpose of RISE Zones is to access institutional assets that have a strong and demonstrated history of commitment to economic development and revitalization in the communities in which they are located. Qualified institutions and local governments develop a targeted strategy to use the institutional assets and financial incentives to attract businesses and create jobs within the zone. The program also incentivizes the location of innovative start-up businesses based on technology developed licensed or poised for commercialization at or in collaboration with qualified Maryland institutions.

A RISE Zone designation will be in effect for 5 years, with a possible additional 5-year renewal. Counties and municipalities are limited to a maximum of three RISE Zones, and the size of each Rise Zone is limited to 500 acres.

The current RISE Zones are:

| Municipality | RISE Zone | Acres | Expires |

| Baltimore City | Morgan State University | 10.2 | 9/27/2023 |

| Baltimore City | University of Maryland - Baltimore (UMB) | 8.36 | 2/15/2025 |

| Baltimore County | Towson University | 419 | 6/12/2028 |

| Montgomery | Montgomery College | 28 | 9/27/2023 |

| Prince George's | Greater College Park | 470.54 | 8/27/2027 |

| Wicomico | Salisbury University | 129.9 | 9/27/2023 |

The benefits for businesses locating in a RISE Zone or an existing business making a significant capital investment or expansion within the RISE Zone include:

There are additional benefits for businesses located within a RISE Zone that have certain nexus to a Qualified Institution:

Commerce administers the designation of the Qualified Institution and RISE Zone. Once Commerce designates the RISE Zone, each Qualified Institution, political subdivision, County and/or Municipality is responsible for qualifying eligible businesses for the Real Property Tax Credit, the Income Tax Credit, and the Rental Assistance Fund.

The designation of a RISE Zone is a two-step process. Institutions must first apply to Commerce to be designated a Qualified Institution. Qualified Institutions may then jointly apply with a county, municipality or the economic development agency of a county or municipality to designate a RISE Zone.

Within 90 days of submission of the application, the applicant will be notified if it has been designated a Qualified Institution.

Within 120 days of submission of an application, the applicants will be notified if the RISE Zone will be designated.

The RISE Zone remains in effect until January 1, 2028, subject to extension by the Maryland General Assembly.