Image

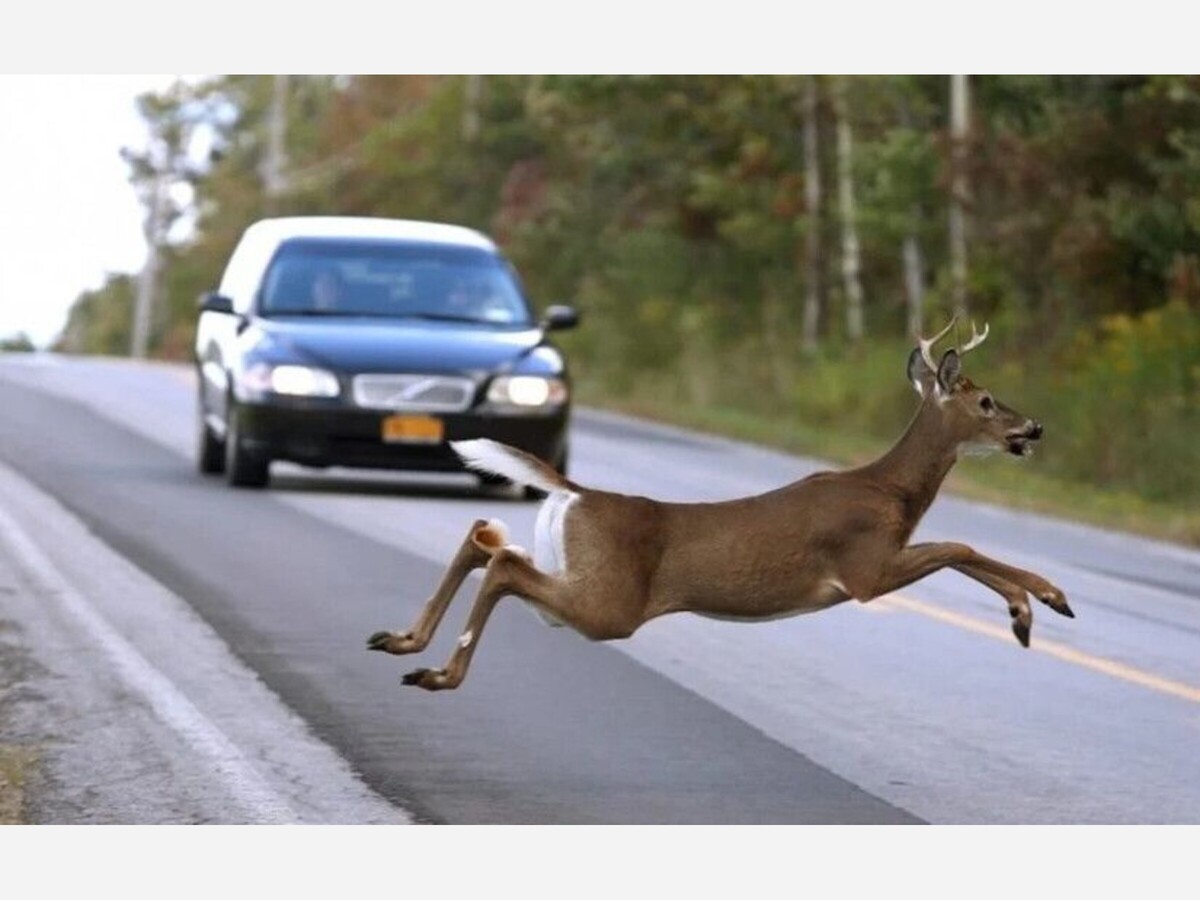

How to Avoid Collisions With Deer This Fall

These tips will keep you safe and help prevent costly repairs

Photo: Getty Images

Photo: Getty ImagesBe on the lookout for deer while you are commuting or cruising to enjoy autumn’s colors. Insurance claims for collisions with animals rise significantly in the fall when deer are mating, with November having the highest claim frequency.

The State Farm insurance company estimates that there were 1.8 million animal collision insurance industry claims for the past year, similar to the year before.

Animal strike claims typically rise dramatically in the fall, peaking in November, an Insurance Institute for Highway Safety spokesman told CR. He explained that insurance claims data shows November typically has more than twice the monthly average and nearly 3.5 times the average for August, when such claims are least likely to be filed. The average claim for a November animal strike from 2013 to 2022 is $4,600, according to IIHS.

It is clear that deer are more active in the fall, but data from the Highway Loss Data Institute (HLDI) shows that animal-related motorist fatalities are also significant in the spring and summer—a reminder for year-round vigilance when driving and a warning that deer are not the only threat.

“Fall brings the dangerous combination of the deer being more active when we’re driving more in the dark due to the shorter daylight hours,” says Jen Stockburger, director of operations at Consumer Reports’ Auto Test Center, which is in a rural area of Connecticut. Deer are most active at dawn and between 6 p.m. and 9 p.m., so use your high beams at those times, Stockburger says.

State Farm cautions that its data shows that risky behavior, such as speeding or using a phone, increases the likelihood of an animal strike by 23 percent.

Due to the risk of leaving your lane or losing control, and leaving the road, braking in a straight line is better than a sudden swerve in many cases, when staring down a potential animal strike. The IIHS reports that about 20 percent of motor vehicle crash deaths result from the vehicle leaving the road and striking a solid object, like a tree or telephone pole.

Slow down. Watch for deer, especially around dawn and between the hours of 6 p.m. and 9 p.m., when they’re most active.

Be aware. Look out for deer-crossing signs and wooded areas where animals are likely to travel. If you travel the same route to and from work every day, you may find deer consistently grazing in the same fields. Make a mental note of when and where you regularly see the animals.

Be alert. If you see an animal on the side of the road, slow down. At night when traffic permits, put on your high beams for improved visibility.

Brake, don’t swerve. Swerving to avoid an animal can put you at risk for hitting another vehicle or losing control of your car. It can also confuse the animal as to which way to go. Instead, just slow down as quickly and safely as you can. Your odds for surviving an accident are better when hitting an animal than when hitting another car.

Assume they have friends. “Where there’s one, there are usually more” often holds true. Deer travel in groups, so if you see one run across the road, expect others to follow.

Don’t rely on deer whistles. These are aftermarket devices that some drivers put on their front bumpers to scare off animals. But animal behavior remains unpredictable, even if you use one of these. State Farm advises, “No scientific evidence supports that car-mounted deer whistles work.”

Buckle up. A seat belt is your best defense for minimizing your risk in a crash. An IIHS study found that most of the people killed in animal-vehicle collisions weren’t wearing their seat belts. Motorcycle riders account for more than half the fatalities, and among that group, nearly half the riders who died were not wearing helmets.

If you hit an animal, move your car safely off the road and call the police or animal control. Don’t attempt to touch an injured animal. Photograph the scene, then call your insurance company when you get home. Damage from animal collisions is usually covered by auto insurance policies.

Repairs made necessary by crashes involving deer and other animals fall under comprehensive insurance, which also covers theft and physical damage from causes other than crashes.

Deer spotted along the road very close to the CR Auto Test Center, which is in a rural area of Connecticut.

Deer spotted along the road very close to the CR Auto Test Center, which is in a rural area of Connecticut.The states are listed in order of the likelihood of a driver having hit an animal between July 1, 2023, and June 30, 2024, according to State Farm.